Student debt an increasing issue

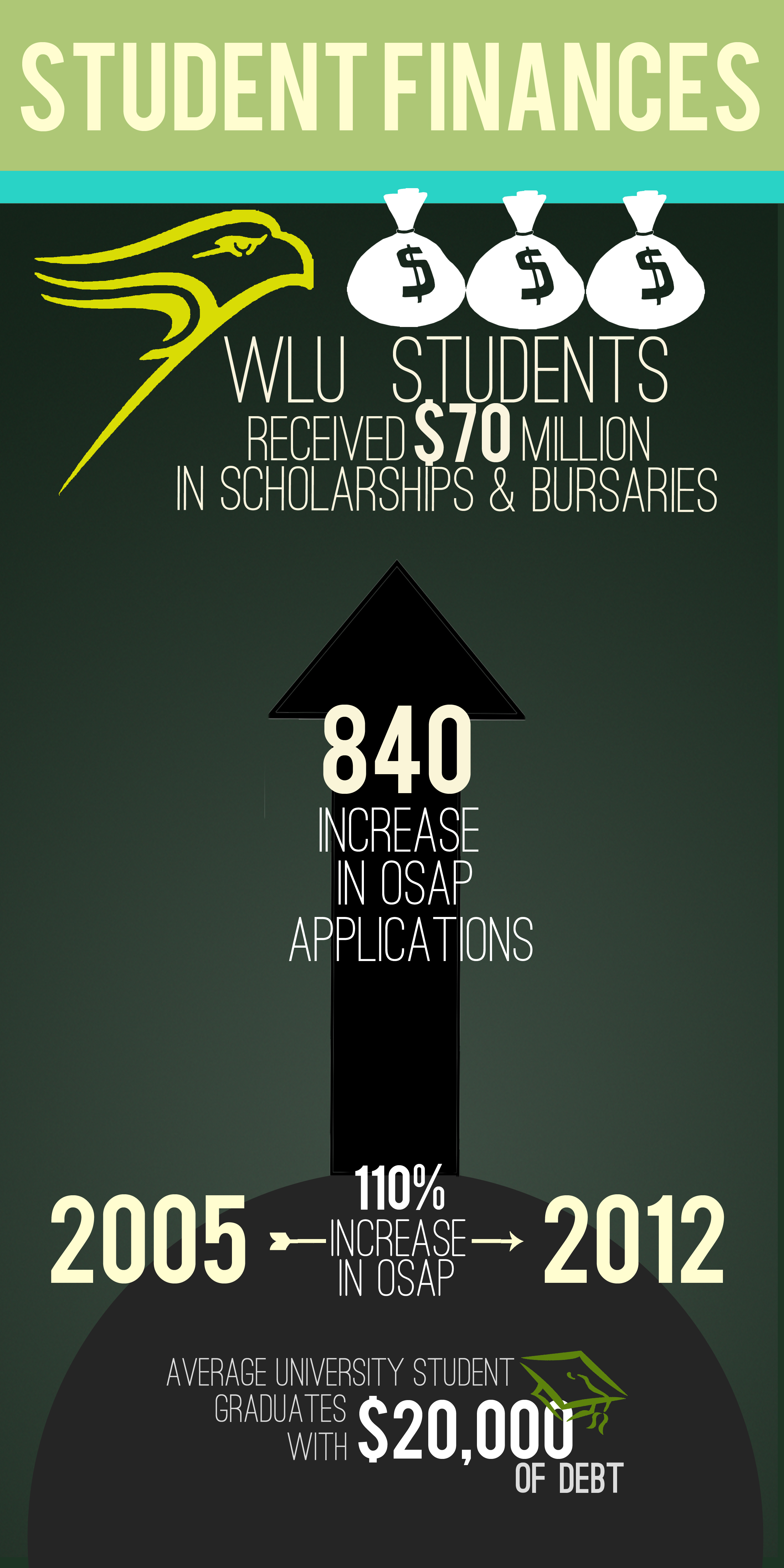

In a recent survey released by the Bank of Montreal, over half of the participating students revealed that they are expecting to graduate with roughly $20,000 in debt — a fate that is not uncommon for the typical Laurier student.

Sabrina Brown, a fourth-year WLU student, expects to graduate — after finishing both her undergrad and teaching degree — with roughly $15,000 in debt despite securing a part-time job and receiving funding from both the Ontario Student Assistance Program (OSAP) and scholarships.

Jordan Burrows, another fourth-year student, has already racked up roughly $9,000 in student debts, despite receiving the 30 per cent Off Ontario Tuition grant and is applying for more OSAP funding as well as to different scholarships for the upcoming year, while also working, in order to pay his tuition.

And with Ontario boasting the highest tuition costs in the country — which are also rising at roughly five per cent a year — students’ financial futures don’t look bright.

For students such as Brown and Burrows, however, new changes being implemented at WLU’s Student Awards Office may be beneficial in securing more funding in a more timely manner in order to pay off the rising costs of a post-secondary education.

Changes to help students

Two main changes are coming to the Student Awards Office this year: the first regarding OSAP, and the second with respect to scholarship and bursary applications.

Pamela Woodburn, student awards officer at Laurier, explained that the changes to the OSAP system have been put in place by the government, with the main change being the introduction of the Master Student Financial Assistance Agreement (MSFAA).

“That form is new this year — it’s for students to confirm their identity,” she explained. “In the past when students came to pick up their OSAP document they had to show their social insurance card and their identification card. That now has changed to a one time process per school.”

The MSFAA document has replaced the loan document, and since it is completed online and then handed in to a postal office, there is no need for students to physically line up to pick up their OSAP funding.

As a result, this change means students no longer have to waste time standing in line in order to pick up their funding. There are some issues with the MSFAA forms. Since they are new this year, many students are unaware of their proper function.

“About 25 per cent of students now have not submitted that sheet,” stated Woodburn.

This is an essential part of the OSAP process for students; without the sheet, funds cannot be directed into their accounts, and their identity cannot be confirmed.

“It’s very student driven now, and the student has to take responsibility and ownership to go in and make sure that their OSAP does process through cleanly,” commented Ruth MacNeil, associate registrar for the student awards office. “If everything follows through like it should it will be quicker for them to get their funds in the fall and winter rather than standing around in lines.”

This new program will also make the process faster for the Student Awards Office. This year, they have 5,700 OSAP applications to process opposed to last year’s 4,860.

Changes to the scholarship and bursary application also aim to positively affect both students applying and the way in which the Student Awards Office functions.

WLU recently spent over $200,000 on new software in order for improvements to be made to the application process for awards.

In the past, students had to search a database to find awards and apply for each one separately on paper.

Now, they will simply have to fill out an online profile that will filter their options based on the information given, and automatically consider them for awards that fit their descriptions.

“The idea behind the profile is that we want students to tell us about themselves,” explained Nancy Helmond, the scholarship officer at the student awards office. “[It’s] a catch all for generic awards.”

MacNeil echoed and expanded upon Helmond’s comments.

“In the past students might have missed [an award] or they may have felt that they were unworthy to apply, but this allows us to say ‘you know what, based on what you have provided us, we can try to get you one of 15 different opportunities’ where they may have only applied for three or four on their own,” she said.

She hopes that this new program will alert students to the vast amount of awards available to them. Last year, WLU gave out roughly $20 million in awards to students, and over $70 million including both awards and OSAP funding.

Will the changes work?

However, since the application process is becoming simpler, an influx of applications may lower a student’s chances of securing funds through awards. For students such as Brown and Burrows, who rely on scholarships and awards, this could be problematic.

Kelli Hughson, a second-year WLU student, has similar views on the importance of finding and securing monetary awards.

“When it comes to winter term I rely on OSAP, other grants and scholarships that I apply for,” she said. “[And] the difficult thing with OSAP is that they measure what your parents make, when your parents aren’t necessarily paying for your schooling.”

And despite the new initiatives in place to aid students with their financial woes, they still have major concerns regarding their debt and how soon it will be paid off upon graduation.

“When I’m done with university I want my biggest concern to be finding the ideal job, I don’t want to be drowning in debt that could take years to pay off,” continued Hughson. “I just don’t want to be 22 years old and feel trapped because of finances.”

Brown also expressed similar feelings.

“I’m worried because I’m a mature student … but at the same time I know I’m responsible with my money; I don’t want to have to worry about [debt], I want to get out there and live my life.”

In order to spread financial awareness, Brown, Burrows and Hughson also shared similar advice for the fellow WLU students: don’t eat on campus, buy textbooks used and only pay for purchases in cash.