Dealing with university student debt

Student debt is an issue for many university students across Ontario, and Wilfrid Laurier University students are no exception.

Rick Camman, vice-president of university affairs at the Wilfrid Laurier University Students’ Union and vice president of administration and human resources at the Ontario Undergraduate Student Alliance, explained that issues surrounding student debt are alarming and need to be addressed.

“I’m not stoked about it, so one of the things I’ve been trying to do is advocate on behalf of Laurier and other schools that are part of [OUSA],” he said.

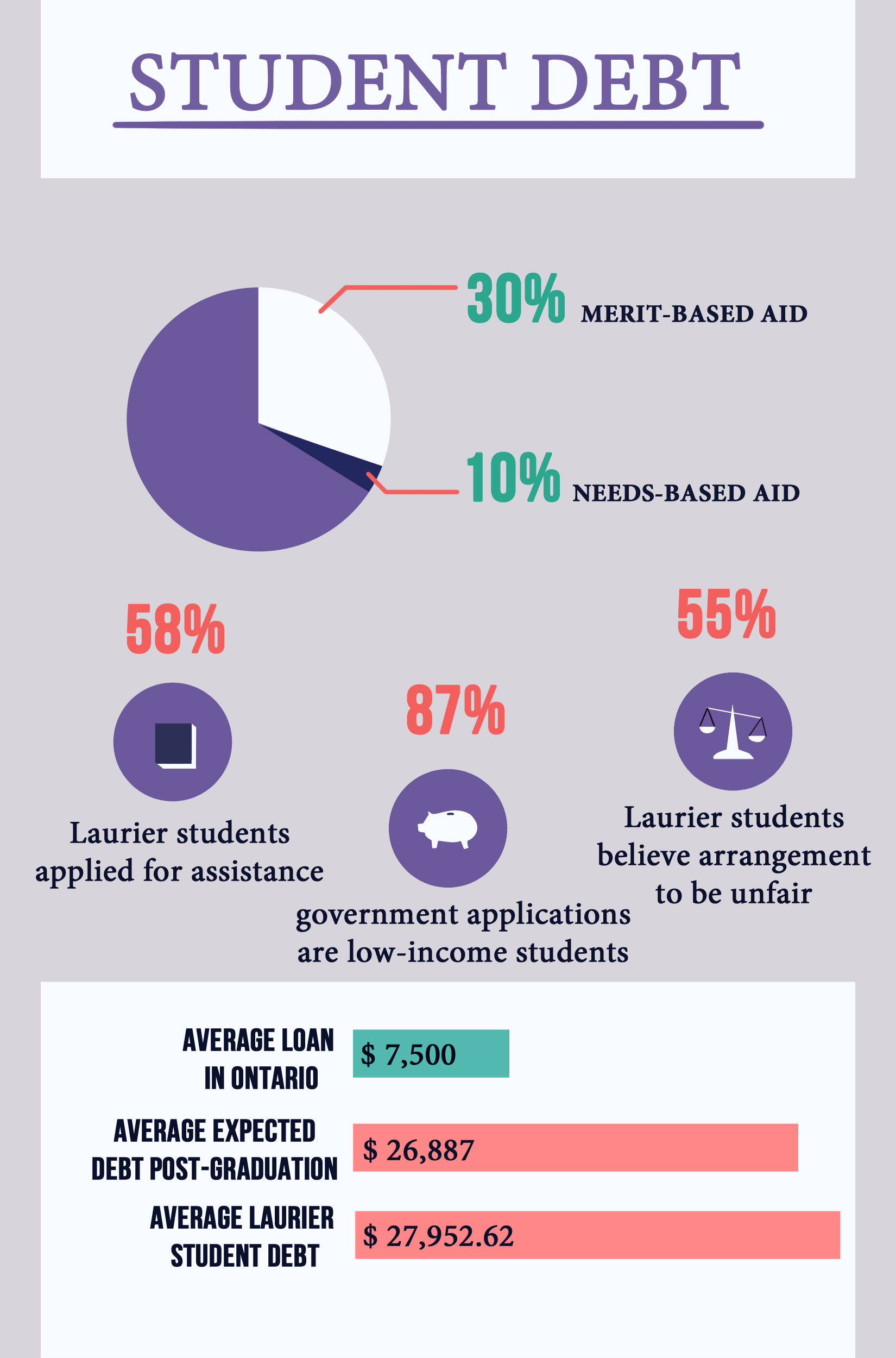

According to a report OUSA released in July 2014 where they surveyed 8,639 students from Laurier, Western University, Brock University, McMaster University, Queen’s University and the University of Waterloo, the average anticipated amount of debt for a student is $26,887.

The average annual loan across all six schools was $7,500 and over 78 per cent of Ontario students are concerned about their level of debt after graduation.

Laurier’s debt

Last year, the Students’ Union completed an initiative called “Wall of Debt,” where they surveyed 117 students and asked them to write down the amount of debt they owed.

According to Camman, 86 people reported having debt, while the remaining 31 had no debt.

The accumulated amount of debt for all 117 students reported was $1.5 million, with an average of $17,393 when those who said they had no debt were excluded.

In the OUSA report, Laurier students ranked in the middle of students applying for financial assistance at 58 per cent.

Among schools that are a part of OUSA, students at Brock University were most likely to indicate that they applied for financial assistance at 65 per cent.

Laurier also ranks within the middle of the group for anticipated debt post-graduation.

“Laurier, overall, the anticipated debt was [around] $27,000, which — either way debt is debt, but it’s a little bit lower than schools like McMaster or Western,” Camman said.

While Laurier is lower than some schools around Ontario, Camman doesn’t believe the difference is dramatic.

“I don’t think there’s much difference because tuition is regulated right now. I think the difference is just in the cost of living. If you’re living in Hamilton or London, maybe the costs are a little higher,” he explained.

In addition, students at each of the six institutions were asked for their opinion on how fair the current funding arrangement is — a “cost-sharing model,” where students and government both fund education.

Fifty-five per cent of Laurier students reported they believe the current funding arrangement is unfair.

OUSA also reported merit- and needs-based scholarships and awards by institution.

Around 30 per cent of financial support for Laurier students is merit-based, while only approximately 10 per cent is needs-based.

This leads to issues for low-income and first-generation students, Camman explained.

“It’s really based on the individual and what they’re capable of” – Rick Camman

Lower income woes

One of the most prevalent issues in the OUSA report was the ability of low-income or first-generation students to pay off their OSAP loans.

87 per cent of government funding applicants are low-income students. 74 per cent of students that apply for government assistance are first-generation students.

Camman stressed that while the funding model loans a large portion of money to low-income students, there needs to be some help when these students try to pay off their loans.

Middle-class or higher-class students tend to have the ability to pay off the loans easier, but Camman says he wants to make sure low-income students are being advocated for.

“It’s a big issue,” Camman said. “There are a lot of interconnecting issues that apply to this.”

Dealing with debt

While issues of dealing with debt are prevalent among all university students, Camman says the reaction can vary based on the person.

“It’s really based on the individual and what they’re capable of,” he said.

The thought of debt affects the daily class life of the student, said Camman, who explained that students can’t be expected to do well in class if they’re worried about paying rent or buying food.

According to a Maclean’s article published in January 2013, 60 per cent of students in Ontario claim they are dealing with debt during school or post-graduation.

According to the OUSA report, 50 per cent of the 8,639 students have a high level of concern over their debt.

“Students are obviously very concerned that they’re not going to be able to pay off their debt post-graduation,” Camman said.

“There’s always going to be debt regardless of if you want to buy a car, a house, things like that. But one of the big things about financial assistance for students is we have to make sure that it’s not necessarily how much debt people are taking on, it’s who is taking on that debt.”

Sam Lambert, president and CEO of the Students’ Union, expressed concern for the mental health issues students experience when they take on large amounts of debt.

“We know it’s tough for students. More students than ever are using or accessing OSAP,” he said, We know it’s affecting mental health because students have so much debt that they have to worry about on top of everything else. So it’s a huge concern.”

Students’ financial situation becomes complex, with the students dealing with education and funding with no real solution.

“Students are very concerned they don’t have enough money to pay for their education. [But] they’re also highly concerned they won’t have enough money to pay their debt,” Camman concluded.